reverse sales tax calculator quebec

Calculates the canada reverse sales taxes HST GST and PST. This app is brought to you by the creators of Hardbacon.

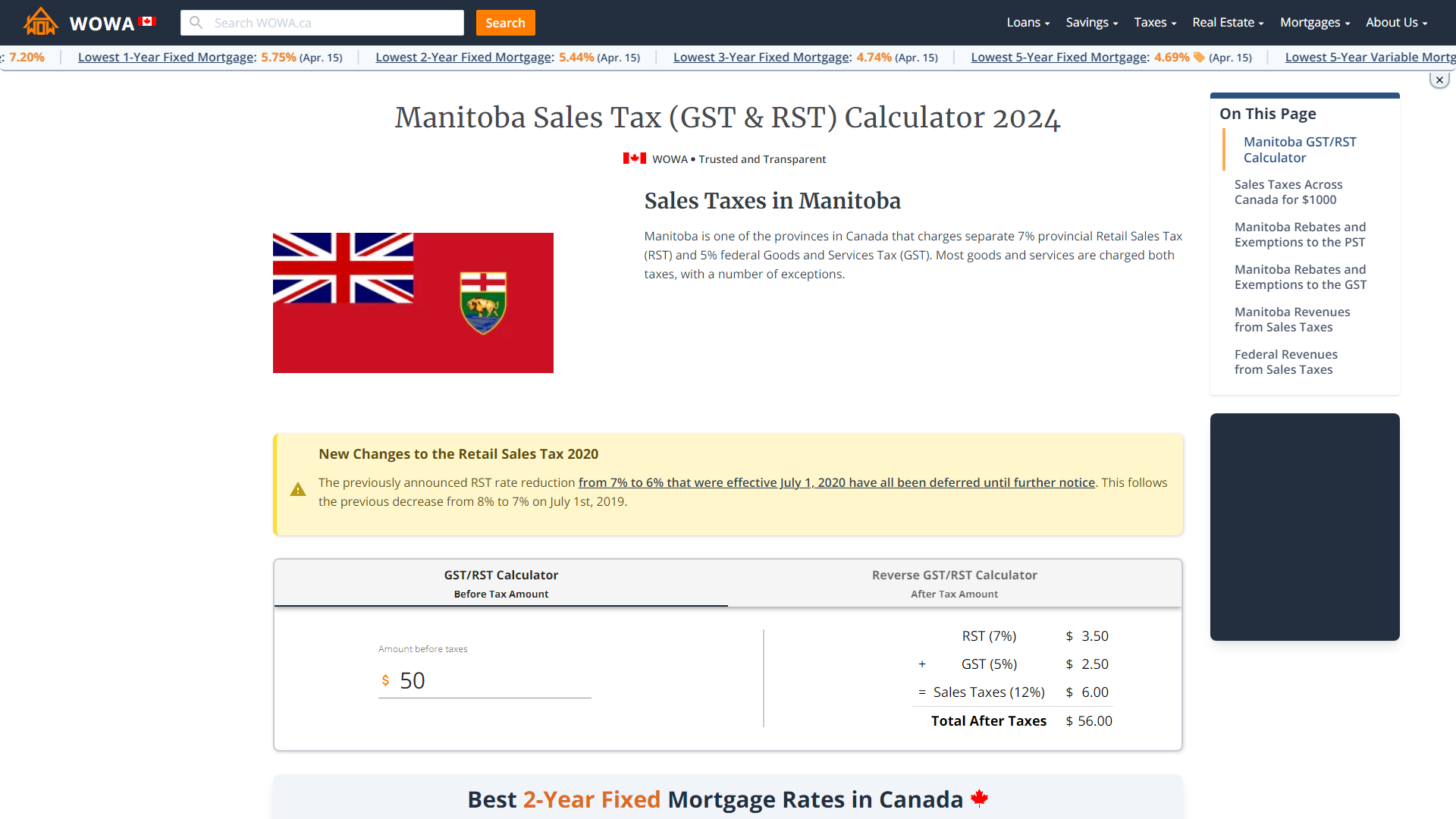

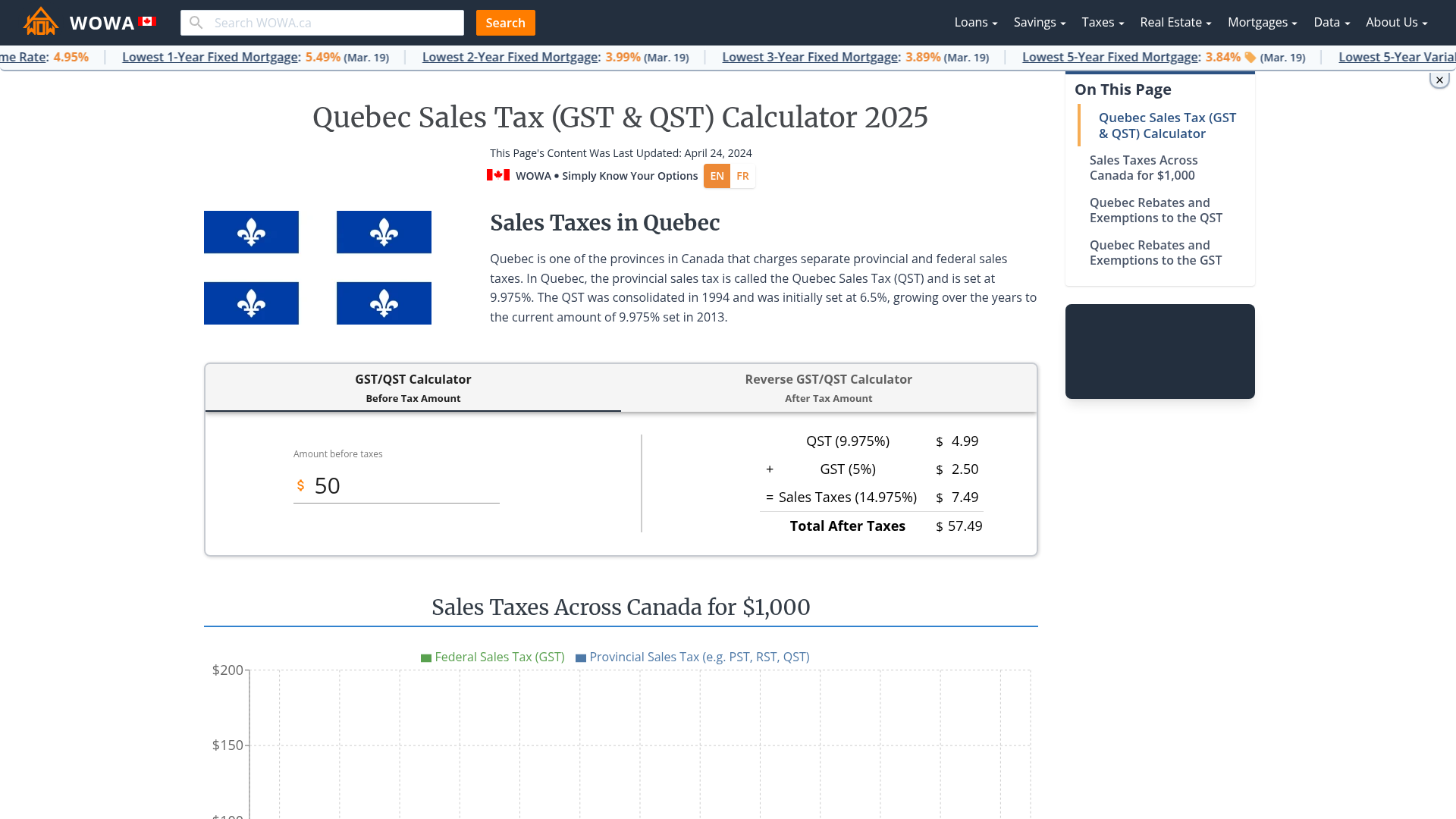

Manitoba Sales Tax Gst Rst Calculator 2022 Wowa Ca

Why A Reverse Sales Tax Calculator is Useful.

. Amount without sales tax GST rate GST amount. Use our calculator to determine your tax or Reverse Quebecs cur Welcome to Calcul Taxes. 13 rows Harmonized Sales Tax HST The Harmonized Sales Tax or HST is a sales tax that is.

The supply of a good or service including zero rated supplies is said to be a taxable supply if it is subject to the GST and QST and is made in the course of commercial activities. Amount without sales tax QST rate QST amount. The QST was consolidated in 1994 and was initially set at 65 growing over the years to the current amount of 9975 set in 2013.

Amount without sales tax x QST rate100 QST amount. Formula for calculating the GST and QST. Online calculator calculates Reverse Québec sales taxes - GST and QST 2020.

Here is how the total is calculated before sales tax. Amount without sales tax QST rate QST amount. GSTQST Calculator Before Tax Amount.

Tax Amount Original Cost - Original Cost 100100 GST or HST or PST Amount without Tax Amount with Taxes - Tax Amount. Beware some bars restaurants charge a tip on the amount TTC while it should be calculated on the amount HT. To find the original price of an item you need this formula.

A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes. The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim. This app is easy to use and fast.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. On March 23 2017 the Saskatchewan PST as raised from. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

In Quebec the provincial sales tax is called the Quebec Sales Tax QST and is set at 9975. Reverse Sales Tax Formula. Amount without sales tax GST rate GST amount.

In Quebec the provincial sales tax is known as Quebec sales tax. GST and QST apply to the price of the supply unless the supply is exempt or zero rated meaning taxable at 0. Reverse GSTQST Calculator After Tax Amount.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Sales Tax Rate Sales Tax Percent 100. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

Amount without sales tax QST rate QST amount. This app is brought to you by the creators of Hardbacon. Price before Tax Total Price with Tax - Sales Tax.

Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a decimal for calculations. This app is so easy to use youll never want to bother again using a calculator app to determine how much taxes youre going to pay on something. Amount before sales tax x GST rate100 GST amount.

The Quebec Sales Tax QST is simply the sales tax applied in. Its great to have a reverse GST QST calculator because it will save you a lot of time when youre trying to figure out how much taxes you have spent on your purchase. Amount without sales tax GST amount QST amount Total amount with sales taxes.

Amount without sales tax QST rate QST amount. It is very good at doing one thing and one thing only. Amount without sales tax GST rate GST amount.

- Tous droits réservés Ontario. This app is easy to use and fast. There are times when you may want to find out the original price of the items youve purchased before tax.

Calculator to calculate sales taxes in Quebec. Here is how the total is calculated before sales tax. Here is how the total is calculated before sales tax.

The TIP is at least equal to the sum of the taxes TPS TVQ is 15. This app is so easy to use youll never want to bother again using a calculator app to determine how much taxes youre going to pay on something. Invest like a pro.

Up to 10 cash back Live Streaming The most reliable way to stream video. In Quebec merchants have to pay GST and QST for all the sales madeCalculate you sales tax. Here is how the total is calculated before sales tax.

Calculating the sales taxes in the province of Quebec Canada. Reverse Sales Tax Calculations. Amount without sales tax GST rate GST amount.

It is very good at doing one thing and one thing only. OP with sales tax OP tax rate in decimal form 1. However you can give more or less depending on the quality of service received.

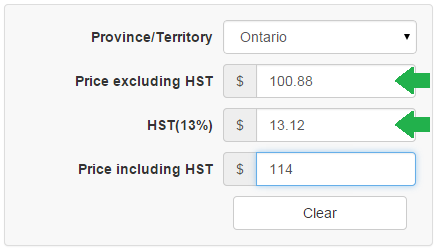

Current HST GST and PST rates table of 2022. Invest like a pro. Instead of using the reverse sales tax calculator you can compute this manually.

Calculating the sales taxes in the province of Quebec Canada.

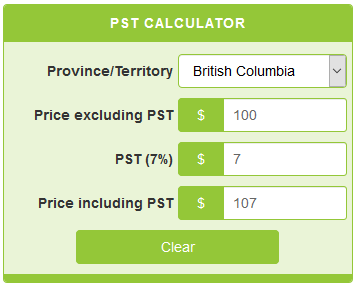

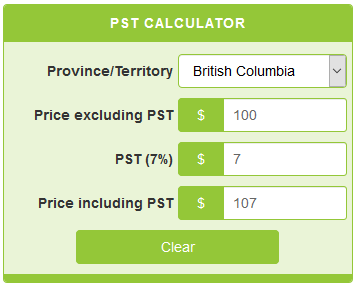

Pst Calculator Calculatorscanada Ca

Gst Calculator Goods And Services Tax Calculation

Quebec Tax Calculator Gst Qst Apps On Google Play

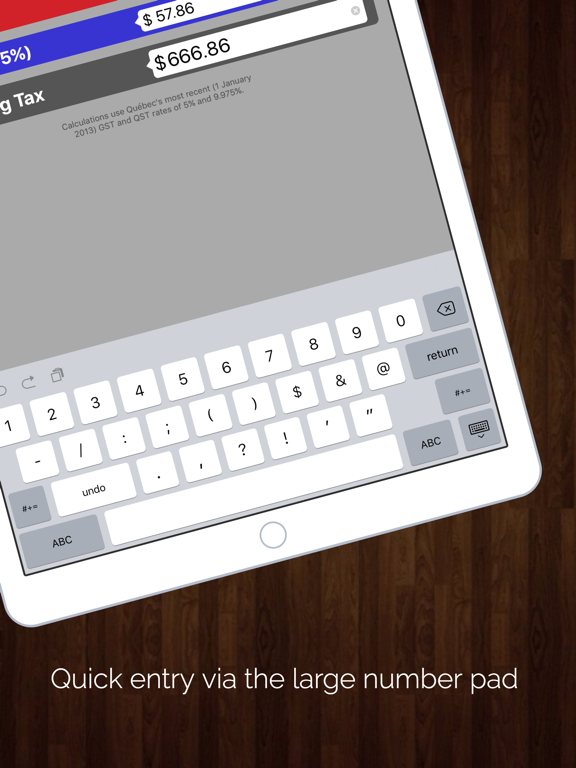

Canada Sales Tax Calculator On The App Store

Updated Canada Sales Tax Calculator Gst Hst Pst Qst For Pc Mac Windows 11 10 8 7 Iphone Ipad Mod Download 2022

Canada Sales Tax Calculator By Tardent Apps Inc

![]()

Quebec Sales Tax Calculator On The App Store

Quebec Tax Calculator Gst Qst Apps On Google Play

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

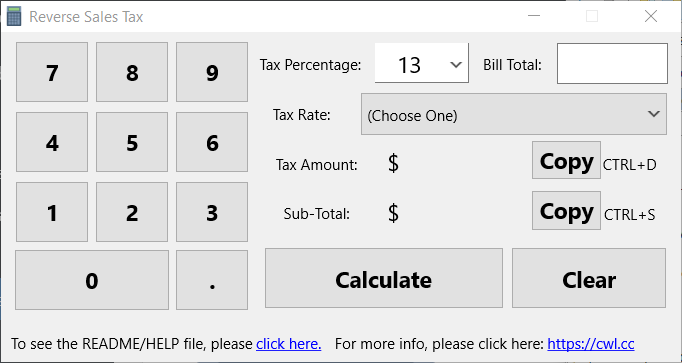

Reverse Hst Calculator Hstcalculator Ca

Calcul Taxes Quebec Tps Tvq By Joseph Pellerin

Vermont Sales Tax Calculator Reverse Sales Dremployee

Quebec Tax Calculator Gst Qst Apps On Google Play

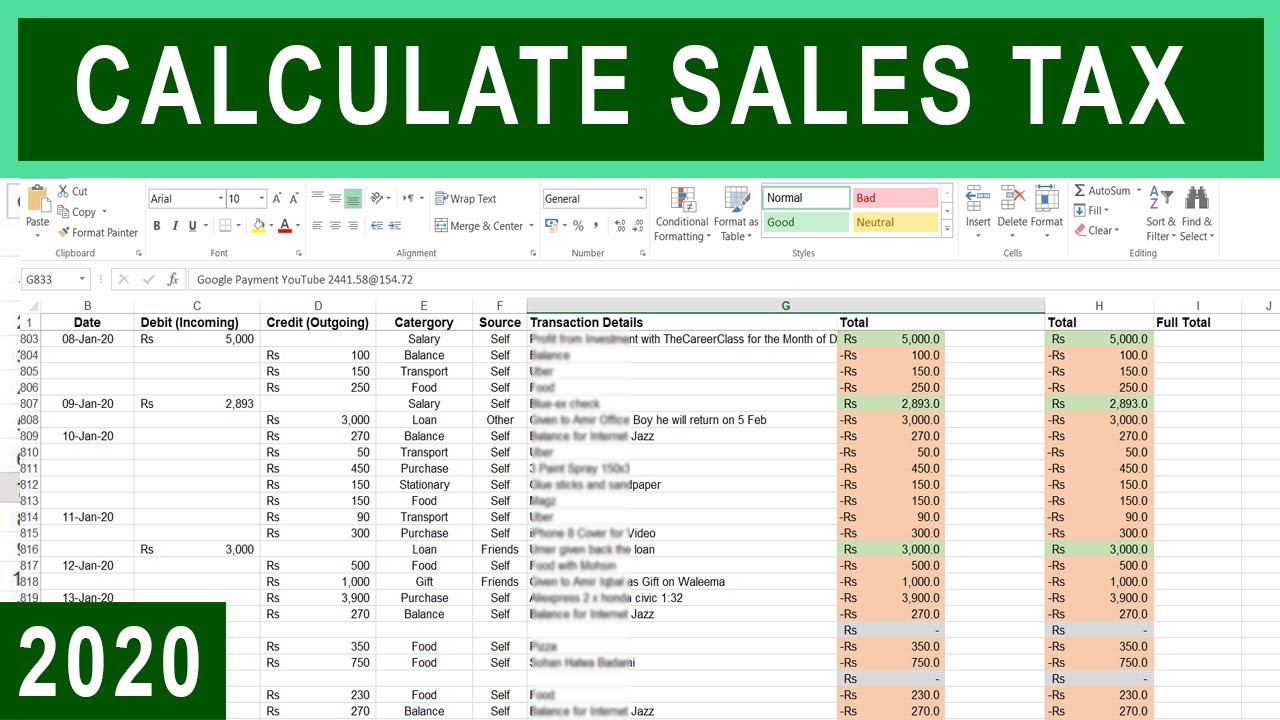

How To Calculate Sales Tax In Excel Tutorial Youtube

Sales Tax Canada Calculator On The App Store

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada